What can be done to help retain driver engagement? Matt MacConnell investigates.

Driver engagement is a factor for all fleets, regardless of size. Engaged drivers are less likely to be involved in an accident, which can help keep insurance costs sustainable and create a safer workforce environment. Another reason for putting a greater emphasis on engagement is driver stress reduction, meaning a driver is less likely to speed, spending less on fuel and lowering the chances of racking up speeding fines.

Driver engagement is a factor for all fleets, regardless of size. Engaged drivers are less likely to be involved in an accident, which can help keep insurance costs sustainable and create a safer workforce environment. Another reason for putting a greater emphasis on engagement is driver stress reduction, meaning a driver is less likely to speed, spending less on fuel and lowering the chances of racking up speeding fines.

As the digital age grows, more technology becomes readily available – and many fleets are already looking to reduce costs by switching to a partial or full EV fleet. Similarly, increasing safety for LCV occupants and pedestrians has become a priority for numerous van manufacturers, with the majority including stacks of safety tech as either a standard feature or an option when releasing a vehicle.

According to a report issued by the Government, 188 fatalities involving LCVs were reported in 2023, an 8% decrease from 2022. In that time, 38 LCV operators died because of an accident. Road casualties involving LCV occupants were down by 4%, with 3,815 incidents recorded. From 2019 to 2023, 29% of van accidents that involved injuries were a result of the driver speeding, being under the influence of alcohol or drugs, not wearing a seatbelt, or using a mobile device. A large contributing factor to all motoring fatalities in 2023 was distraction or impairment, while speeding topped the list.

More monitoring please

Monitoring driver engagement can help fleet managers coach and implement defensive driving practices. This process can be as simple as rolling out AI cameras or installing logging software that can alert fleet managers whenever there’s a negative shift in a driver’s behaviour.

“AI-powered analysis will enable the telematics system to understand where issues exist and take the appropriate steps to resolve these exceptions. It can increasingly be used to interrogate a wide range of data and video sources — behaviour, incidents, near misses, fuel usage, speed limits, location, weather conditions — to create a holistic view of driver performance,” says Steve Thomas, managing director at Inseego UK, an LCV technology supplier.

“AI-powered analysis will enable the telematics system to understand where issues exist and take the appropriate steps to resolve these exceptions. It can increasingly be used to interrogate a wide range of data and video sources — behaviour, incidents, near misses, fuel usage, speed limits, location, weather conditions — to create a holistic view of driver performance,” says Steve Thomas, managing director at Inseego UK, an LCV technology supplier.

“A fleet manager can use a telematics system to create a true picture of fleet risk by combining multiple data sets. Someone speeding, in the rain, outside a school is clearly a higher risk than someone marginally over the speed limit in dry conditions on a motorway. But most current systems would not differentiate, making it harder to prioritise intervention.”

Thomas believes that the industry will soon start to see telematics handle many aspects of fleet management, including training, compliance, vehicle usage and working hours, to take on much of the hard work.

“Many driver engagement processes will soon move from human intervention to automatic system management, leaving the fleet manager to deal with the 2-3% that truly requires their attention,” he predicts.

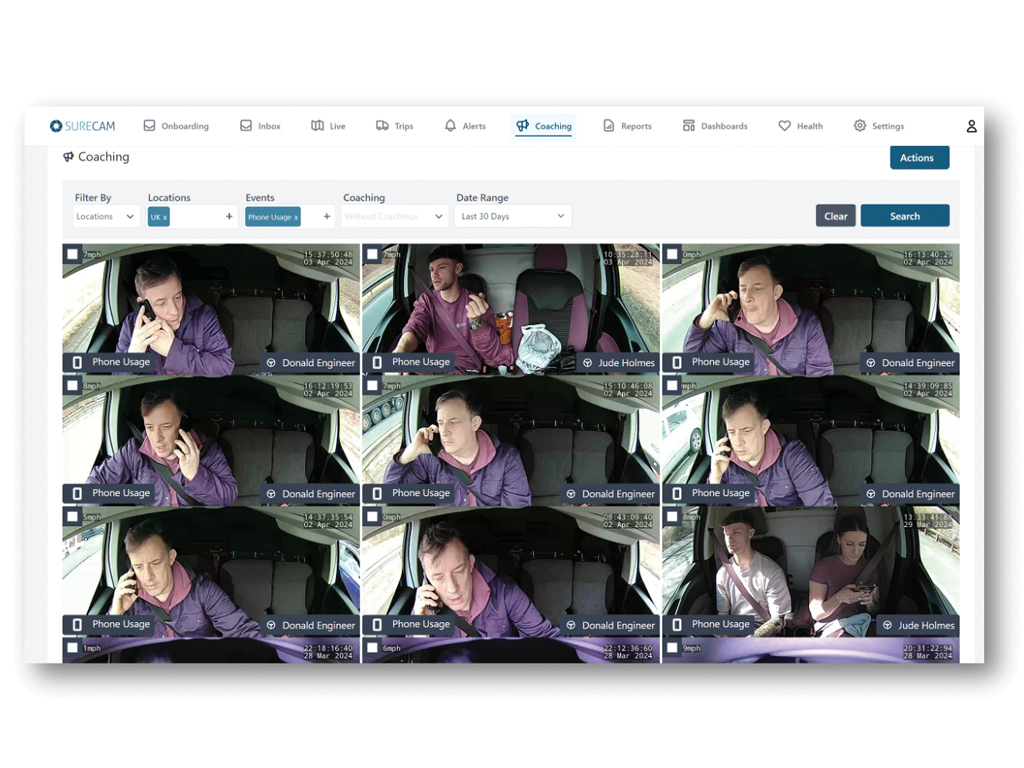

Meanwhile, SureCam has launched a driver coaching system to help van fleets make the most of their smart vehicle cameras. The software solution is designed to remove over 90% of vehicle alerts while, at the same time, automate coaching processes to effectively manage driver engagement, remediation, and escalation.

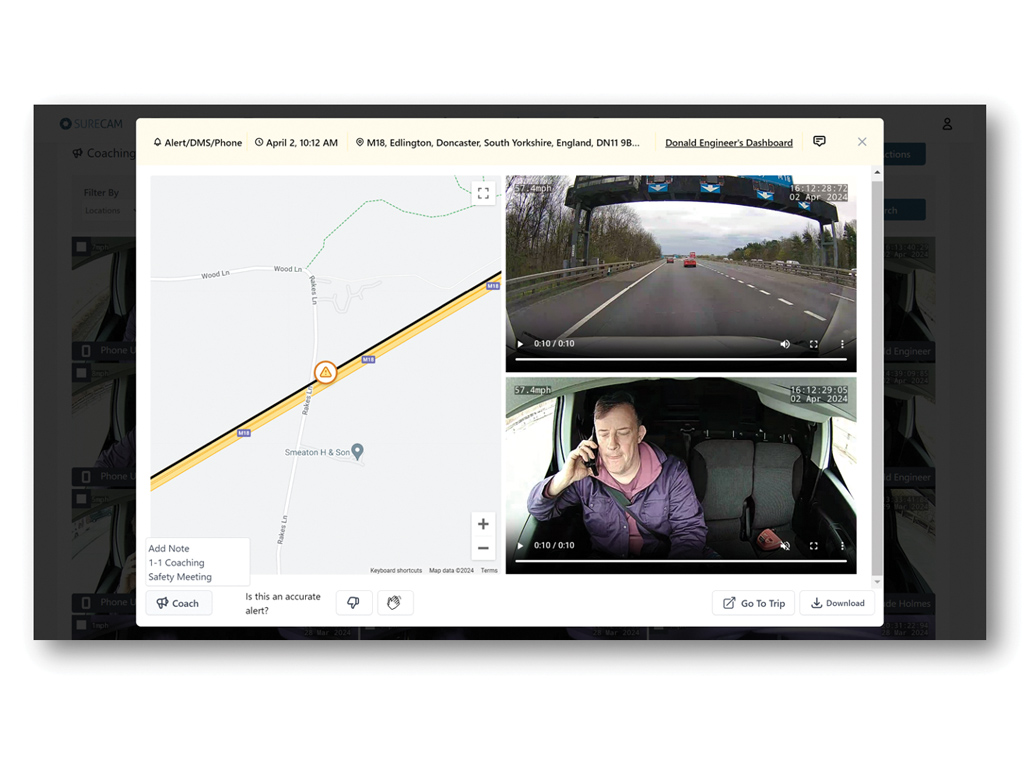

Sam Footer, the company’s partnership director, explains that there is a growing number of intelligent dashcams that can not only capture footage but also engage directly with drivers regarding distraction and fatigue.

“Organisations can now identify risk-generating events behind the wheel and automatically prompt the driver to change their behaviour with real-time voice instructions,” he says.

“Event alerts are then sent back to base to ensure coaching and training is focused and relevant to their drivers.”

Of course, implementing various systems that can monitor fleet operations means a level of uptake will be required by back-office staff. Fleet operators are struggling to handle the avalanche of alerts and video uploads generated by AI cameras, claims Footer.

How to reduce risk

The challenge of fleet and video telematics is often how to best compile, review and then act on visible trends, which is where the risk reduction and return on investment sits, says Vernon Bonser, UK sales director at Queclink Wireless Solutions.

“The time needed to simply examine daily driver behaviour events for a medium- or large-sized fleet is significant and would be impossible for a single person or a small department to achieve efficiently,” says Bonser. “When you add video into the equation, imagine how much more resource is required to review the gathered vehicle and driver footage.”

AX Innovation says that telematics software plays a big role in engaging fleet and company car drivers by providing real-time data that creates hugely valuable insights. It’s vital that this data-driven feedback is used so that drivers buy into the concept for businesses and staff to realise the full benefits.

“The data collected by these systems can be used to protect and reward drivers rather than simply penalise them,” says Vince Powell, MD of AX Innovation. “By highlighting positive behaviours such as smooth braking or fuel-efficient driving, companies can create incentive programmes that recognise safer driving.”

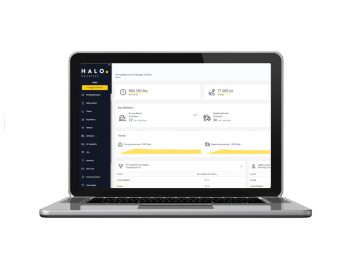

In a bid to reduce driver and fleet risk, Drivetech has recently launched Halo Insights, a fleet data aggregation platform. It consolidates fleet data into a single interface and gives fleet managers an overview of driver risk, operations and fleet costs. Halo Insights will be available in 45 languages and the AA plans to roll it out to 70 other countries.

“If you look at fatalities as a graph from almost the 1960s through to today, you’ll see these great drops in the number of fatalities over time, thanks to better-managed speed limits and seat belt usage,” says Bill Chambers, commercial consultant at Drivetech.

“From 2011 onwards, it begins to creep. Unless you, as an organisation, are engaging with the driver, you’re never going to have an impact.”

Halo Insights creates an environment that uses real-time telemetry data that comes from the vehicle’s data logger. API then creates specific insights and allows the fleet manager to tailor tuition on where the driver’s behaviour can be improved.

“It allows fleet managers to assign reporting to the various line managers that look after specific drivers. We can then create a dashboard specific for line managers that can contain information, such as here are your worst top five drivers,” adds Chambers.

Halo collects information on fuel consumption, accident management, insurance, telematics and fleet costs. This allows for fleet managers to check how well a fleet is performing. Fleets need to look at all these elements rather than just one.

“For example, someone on your fleet might have no recorded incidents, but a driver could be racking up speeding fines, or their van could have poor mpg and a high pence per mile cost,” reasons Chambers.

“Therefore, with all the data combined, we can give a single risk score to an individual. Engaging with the driver is a triggered intervention. Using real-time data from the telematics is used to ping an SMS to the driver, so they are engaged with the information. This can then be escalated into content and the driver will be given tailored events to help tackle any behaviour, such as constant harsh cornering or harsh braking.”

If no result is generated with the content, Drivetech has 300-plus driving trainers that will get into the cab with the driver for physical training.

Play the game

Gamification techniques can also be included and may be the way forward if fleets have issues relaying specific information to the drivers involved. A few companies run incentive programs that are tied to driver scores, and if a driver consecutively follows implemented safe driving rules, they are then rewarded with vouchers or a bonus.

Drivetech is device agnostic, meaning it doesn’t matter what telemetry is installed in the LCV. For initial set-up, it will liaise with the fleet manager and any existing supply chain. After this step, there will be a month of observation to understand which drivers should be targeted.