LCV sold volumes rose at BCA during July 2024 to reach the highest point on record, as the UK remarketing firm increased its sales programme to offer a greater choice of stock to customers.

Whilst LCV pricing remains volatile, buyer engagement remains positive and total buyer numbers have risen substantially since the start of the year.

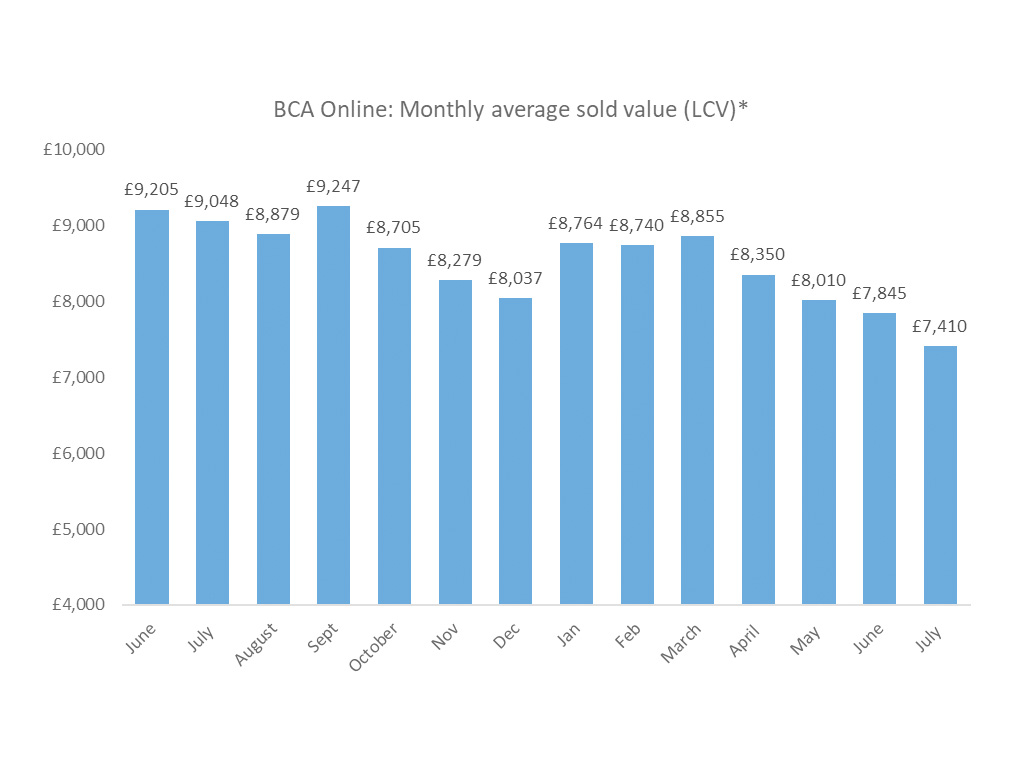

Average monthly LCV values slipped to £7,410 in July, down from £7,845 in June, with another significant downward guide price move influencing the trend.

Average values have been under pressure since the second quarter of the calendar year, with a large supply of standard model vans creating significant market pressure. Many of these remain a hangover from the pandemic, as manufacturers were forced into producing base specification models due to parts supply bottlenecks and orders were rushed through to meet the rising demand from the contract hire and rental markets.

Stuart Pearson, BCA COO UK commented: “The LCV market has been experiencing a fairly significant pricing realignment over the last few months, and there’s likely still greater movements to come.”

“Whilst there isn’t any shortage of buyer interest, the sellers that are taking a very pragmatic approach to investing in the right level of preparation, along with valuing vehicles realistically, are achieving the best results. With many base spec vehicles in the system, buyers will inevitably focus their attention on those that can be turned the fastest and the delta between the best and worst condition is likely to increase further.”

“We continue to work very closely with our customers to ensure that we’re presenting them with live market pricing to support their decision making, because the reality is that by the mid-point of the month, the value of an average LCV has potentially changed significantly from the start.”

He added “While this may seem like challenging news, demand for LCV stock remains strong and buyer engagement has been at record levels at BCA this year. The guide price move into August certainly injected some realism into the market, but currently there’s still the expectation of further moves which should bring sellers and buyers closer together in their expectations.”