Telematics firm The Floow has launched a new commercial lines insurance telematics platform aimed at small fleets.

The platform is designed for insurers to position to small fleets looking for an insurance policy, and takes data from the insurer’s preferred selection of either an OBD or fitted device, which is scored and presented back to the insurer and the fleet manager via two different dedicated portals.

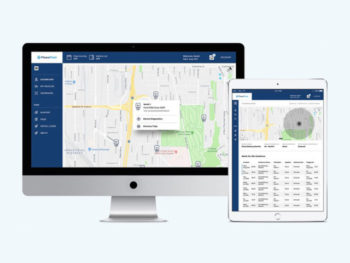

The fleet manager portal can be accessed via any device and enables them to monitor and protect their fleet assets by tracking driving behaviour – including accessing personalised driver scores – and the location of vehicles. Fleet managers can set geofences for their vehicles with event trigger notifications for each vehicle.

The solution follows the launch earlier this year of the FloowDrive personal lines insurance telematics platform, which uses smartphones to provide driver data, and will bring bespoke fleet benefits, including the ability to better manage risk and potentially reduce their insurance premiums.

Aldo Monteforte, CEO of The Floow, commented: “With six years’ experience shaping the telematics market, our new FloowFleet product provides a robust, reliable fleet telematics solution that’s quick-to-deploy and easy to use. FloowFleet is supported by a strong product roadmap, and we have plans for multiple new features to launch in the coming year.”